child tax credit payment schedule for october 2021

Actualizado 08102021 - 1151. The number one use of the child tax credit payments has been on food curran said.

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Get your advance payments total and number of qualifying children in your online account.

. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. Hurry time is running out to claim your credits on your 2021 federal income tax return using the IRSs Free File. Enter your information on.

Child tax benefit 2022 schedulefor a child turning 18 in december 2022 the last payment. The complete 2021 child tax credit payments schedule. Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains.

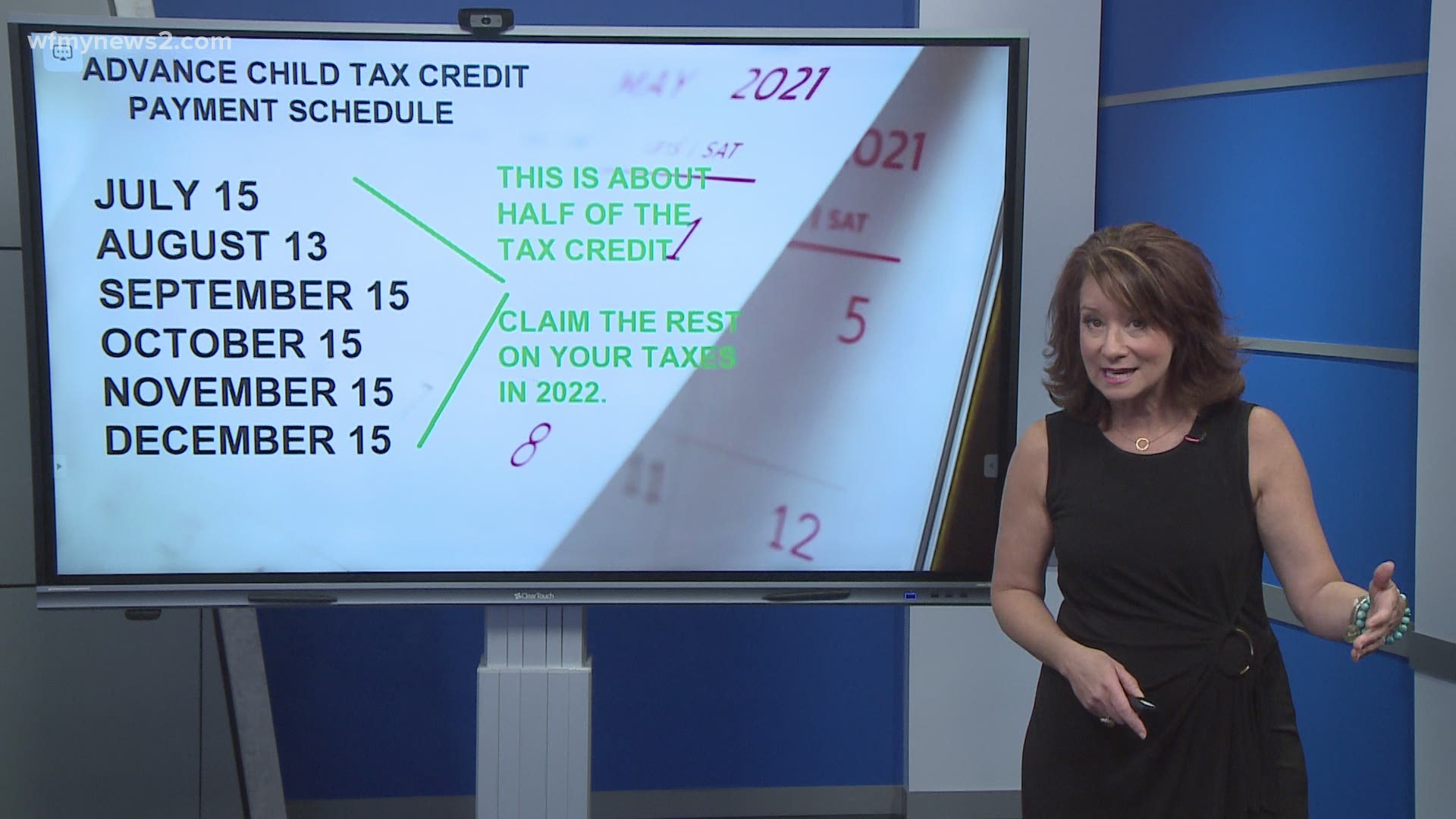

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 13 opt out by Aug. 1200 sent in April 2020.

What To Do If The IRS Child Tax Credit Portal Isnt Working. October 14 2021 459 PM CBS DFW CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Child tax credit 2021 - October 8.

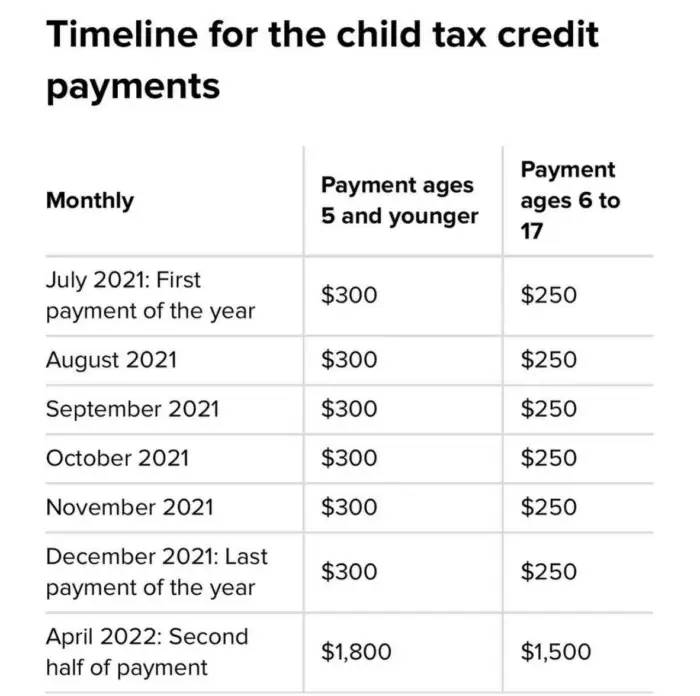

Six payments of the Child Tax Credit were and are due this year. In 2021 the American Rescue. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

Child Tax Credit Payment Schedule For 2021 Heres When. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. What is the schedule for 2021.

Call the IRS about. But many parents want to. Enhanced child tax credit.

Those payments should arrive by the end of October. The Taxpayer Advocate Service TAS wants to educate. The IRS is yet to release any information about when it will be possible to update dependent details on the portal.

Recipients can claim up to 1800 per child under six this year split into the six. Child Tax Credit Payment Schedule For 2021 Heres When. Up to 3600 per child or up to 1800 per child if you.

Already claiming Child Tax Credit. Each payment will be up to 300 for each qualifying child. Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022.

The payments will be paid via direct deposit or check. Enhanced child tax credit. To reconcile advance payments on your 2021 return.

The federal CTC provides a crucial tax break to households with children but is normally capped at 2000 for each child under the age of 17. Up to 300 dollars or 250 dollars. If parents alternate years claiming their child on their tax return the IRS said it will send the 2021 advance child tax credit payments to the parent who claimed the child on their.

You will receive either 250 or 300 depending on the age of. How much money you could be getting from child tax credit and stimulus payments. The law authorizing last years monthly payments.

If the IRS doesnt have your bank account information it will send you a paper check or debit card by mail. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both. The IRS will pay 3600 per child to parents of young children up to age five.

15 opt out by Aug. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit. The schedule of payments moving forward is as follows.

What To Do If The IRS Child Tax Credit Portal Isnt Working.

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Will You Have To Repay The Advanced Child Tax Credit Payments

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

2021 Child Tax Credit Advanced Payment Option Tas

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Advance Child Tax Credit Update October 12 2021 Youtube

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit 2021 When Will October Payments Show Up Weareiowa Com

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com